Examination for promotion to the cadre of Inspector Posts for the year 2010 to be held on 6th & 7th August 2011

As per DG, Posts letter No.A-34012/02/2010-DE dated

(a) Not less than five years of regular service in the grade of Postal/Sorting Assistants, Lower Selection Grade officials, Stenographers in:

- Post offices, Railway Mail Services

- Postal/Railway Mail Service, Divisional offices, Circle Office

- Foreign post

- Returned Letter Offices

- Postal Stores Depots

- Savings Bank Control Organization

- Internal Check Organization of the Circle.

(b) (i) Not less than five years regular service in Postal Accounts Office in the grade of:

(b) (ii) Not less than nine years regular service in the grade of Lower Division Clerks in Postal Accounts Office

3. Age limit

The applicant should not be over 40 years of age as on

(i) SC/ST: 5 years i.e. the age should not exceed 45 years as on 1.7.2010

(ii) In respect of officials who are on deputation to APS and officials who have served in APS, the period of service rendered in the APS will be reduced from their age for the purpose of upper age limit.

4. Number of chances:

(i) A candidate is allowed a maximum of four (4) chances to appear in the examination provided that those candidates who secure more than 70 % aggregate marks in the 4th chance may be allowed one more chance as a special case and provided further that a candidate belonging to SC/ST may, subject to his eligibility, be allowed a maximum of six (6) chances to appear in the examination provided further that the said candidate shall, if he is successful in the examination on his 5th or 6th chance be entitled to be appointed only to a post reserved for the SC/ST as the case may be.

(ii) The following concessions are admissible to officials who are serving or have served in the Army Postal Service.

(a) The period of service rendered in the Army Postal Service will be deducted from their age for purposes of the upper age limit.

(b) If they have not already availed themselves of the maximum number of chances before joining the Army Postal Service, they will be allowed to have a maximum of two chances while serving in Army Postal Service, which will not be counted against the maximum number of four chances admissible.

5. Ability to ride a bicycle:

The applicant should be able to ride a bicycle. If the applicant is unable to ride a bicycle at the time of application, he will be given two months time to learn it after he has been selected. If he fails to learn it within two months his name will be removed from the approved list.

6. Submission of application by willing candidates:

(i) Application from willing candidates may please be obtained from

(ii) In respect of applicants working in the Office of the Chief Postmaster General, RLO Trivandrum and Office of the Postmaster General Kochi/Kozhikode the applicants may submit the applications to the Asst.Director (Rectt) , Office of the Chief Postmaster General, Kerala Circle, Trivandrum- 695 033 on or before 11-07-2011

(iii) The applications in respect of willingness of candidates received should be forwarded to this office duly checked, so as to reach this office on or before

7. The Application Form kits will be issued to the eligible candidates on receipt of willingness from the eligible candidates.

8. Concessions to officials serving in APS.

The concessions regarding absorption as Inspector Posts on certain conditions in respect of candidates serving in the APS who secure minimum qualifying marks will continue as may be decided by the Central Government, from time to time.

9. It is noticed that quite a large number of officials request for withdrawal of candidature under one or other reasons. These are received months after the exam. In future, such applications received will be considered only if they satisfy the conditions in Rule 279 (5) of Postal Manual Volume IV (Pt-1).

APPLICATION TO BE SUBMITTED BY WILLING CANDIDATES FOR ADMISSION TO THE EXAMINATION FORTHE INSPECTOR OF POSTS - 2010

| 1 | Name of the Applicant (In Block letters) | |

| 2 | Date of Birth and Age (As on | |

| 3 | Whether SC/ST. If reply is `Yes` indicate the name of the Caste/Tribe | |

| 4 | Educational Qualification | |

| 5 | Whether you are Ex-Servicemen? | |

| 6 | Have you served in the APS? If so furnish details | From To |

| 7 | Are you now serving in APS? If reply is yes, date from which serving | |

| 8 | Date from which continuously working as PA/SA/LDC/LSG and the name of the office where working at present | Postal Assistant from………. Sorting Assistant from………. LDC……….. Office from……… UDC ………. Office from…….. LSG…………Office from……… |

| 9 | Date of appointment to a departmental Post in the P&T Department and the name of the cadre thereof. | Appointed as……………….. From……………………………. |

| 10 | Date from which pmt/QP & the name of cadre thereof | Pmt/QP in the………………. w.e.f ……………….. |

| 11 | Have you appeared for the IPO/IRM Examination previously, If so furnish details such as year of Examination and Roll No while in Civil Services & APS Services separately | 1.…………..Exam Roll No………….. 2…………….Exam Roll No………….. 3…………….Exam Roll No…………… |

| 12 | Do you wish to answer any paper(s) in Hindi | |

| 13 | Can you ride Bicycle? |

I…………………………………………………………………..hereby declare that the information furnished above is true to the best of my knowledge and belief.

Place.

Date.

Signature of candidate

The information furnished against questions 2 to 10 have been verified and found correct/corrected.

Place.

Date.

Signature of authority maintaining Service Book

The information furnished against question 11 has been checked and found correct. The candidature of the applicant is Recommended/Not Recommended.

(Signature of)

Divisional Supdt/Supdt. PSD/CSD/

Asst.Director CO/RO

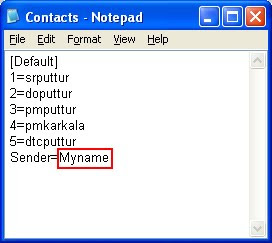

Copy both these files to your PC and create a shortcut for Glink to the Desktop.Edit the Contacts.ini file as per your need. Do not add "@gmail.com" suffix to any ids.You can add up to 30 email ids.The Sender name in the ini file must be your name.You can however change the name when using the exe.

Copy both these files to your PC and create a shortcut for Glink to the Desktop.Edit the Contacts.ini file as per your need. Do not add "@gmail.com" suffix to any ids.You can add up to 30 email ids.The Sender name in the ini file must be your name.You can however change the name when using the exe. Contacts.ini file

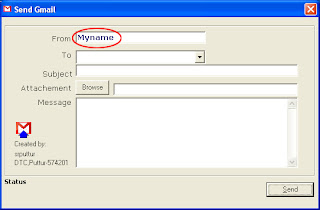

Contacts.ini file In the next Window,the name of the Sender will appear as per the configuration done in Contacts.ini.You can change here itself if desired. Select the to ID. You can also type any id here.Mention the Subject.Attachment is not mandatory.If attachment is there, then click Browse button.

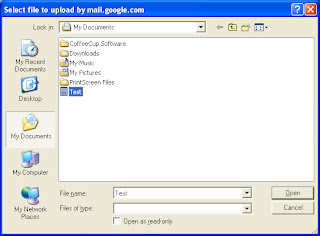

In the next Window,the name of the Sender will appear as per the configuration done in Contacts.ini.You can change here itself if desired. Select the to ID. You can also type any id here.Mention the Subject.Attachment is not mandatory.If attachment is there, then click Browse button. Select the required file. Any file permissible by Google can be attached. Click Send button. If all the inputs are correct, Message will be sent. When the "Message sent" message appears, click OK. Now you can send the same message to other IDs also simply selecting the ID and clicking Send button.

Select the required file. Any file permissible by Google can be attached. Click Send button. If all the inputs are correct, Message will be sent. When the "Message sent" message appears, click OK. Now you can send the same message to other IDs also simply selecting the ID and clicking Send button.